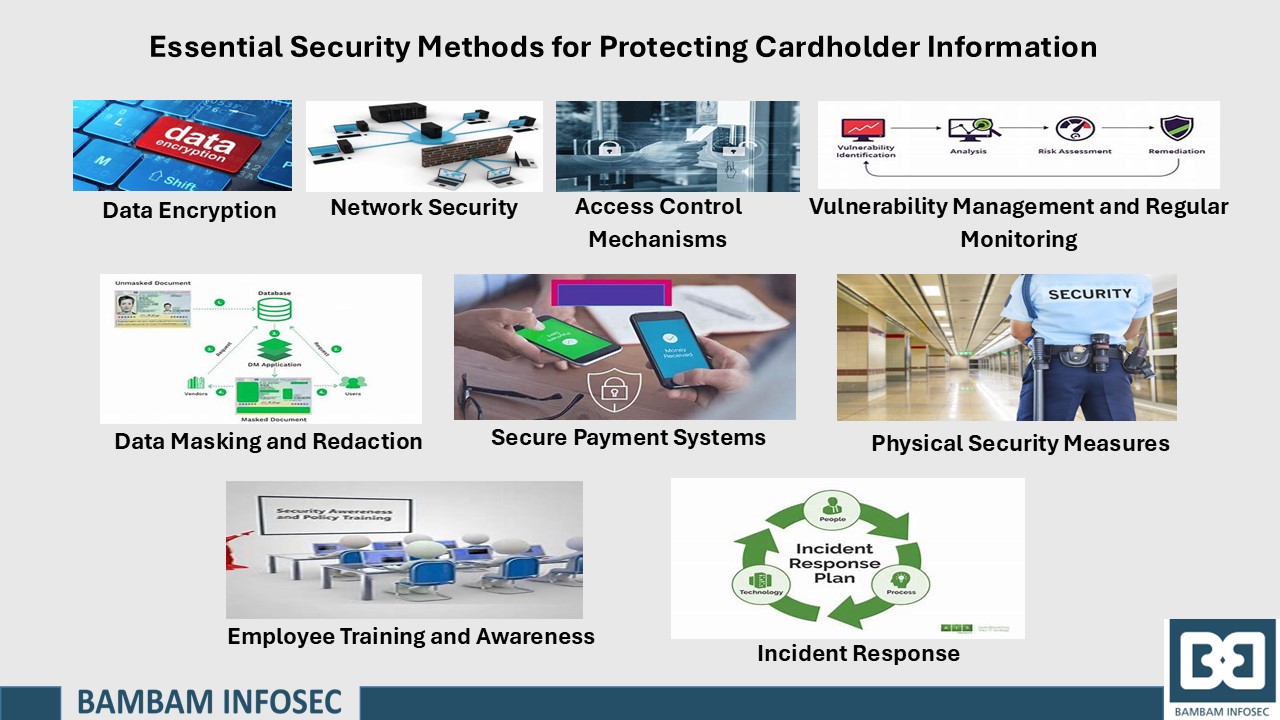

Cardholder Protection Method

As digital transactions surge, protecting cardholder information has become more critical than ever for both businesses and consumers. Today, card payments and online purchases are commonplace, with global e-commerce sales expected to reach $6 trillion by 2024. However, this growth in digital commerce has been accompanied by a dramatic rise in cybercrime, with fraudsters exploiting weak points in payment systems to access and misuse sensitive data. In 2023 alone, consumers made 368,379 reports of fraud related to online shopping, resulting in $392 million in losses, with this number anticipated to rise as technology advances, making effective security measures a necessity rather than a choice.

Without sufficient protection, businesses risk exposing their customers’ sensitive information to cyber threats, potentially compromising customer trust and damaging the brand’s reputation. Cardholder data—such as credit card numbers, expiration dates, and CVV codes—represents some of the most sensitive information a consumer can share. Various security standards, such as the Payment Card Industry Data Security Standard (PCI DSS) and Information Security Management System (ISMS), have been established to set baseline requirements for the safe processing, transmitting, and storage of payment card data. These standards mandate specific security measures that businesses must adopt to protect sensitive information throughout the payment process.

Let’s explore some essential security measures and methods that organizations can implement to protect cardholder information, focusing on best practices and security standards that help prevent data breaches and secure sensitive data against cyber threats.

Data Encryption

Data encryption is fundamental in securing cardholder information both at rest and in transit. Organizations are required to encrypt cardholder data with strong cryptography and security protocols to protect sensitive information as it is transferred across public and private networks. This reduces the risk of data exposure in case of interception during transmission. Methods include:

- TLS (Transport Layer Security): For data in transit, TLS is essential to encrypt data during transmission, securing it from interception or tampering.

- AES (Advanced Encryption Standard): Used for data at rest, AES encryption ensures that even if data is accessed, it remains unreadable without the appropriate decryption key.

- Tokenization: This replaces sensitive data with unique identification symbols (tokens), making the original data inaccessible in unauthorized systems.

Access Control Mechanisms

Limiting access to cardholder data is critical. Only authorized personnel should have access to cardholder information, which is controlled through strong access policies. Additionally, the principle of least privilege mandates that individuals have access only to the information and systems necessary for their roles. Security standards recommend access control methods such as:

- Unique User IDs: Unique identification is required for each user, enabling precise tracking and accountability in case of data access issues.

- Strong Password Policies: Passwords should meet complexity requirements and be changed regularly. Password should not be default or easily guessable.

- Role-Based Access Control (RBAC): Implement RBAC to limit data access based on the user’s role, ensuring that employees only access data necessary for their duties. Only specific roles should be granted access to sensitive cardholder information.

- Multi-Factor Authentication (MFA): MFA is used to verify identities. Implementing MFA for accessing sensitive data ensures that even if a password is compromised, an additional verification step is required. Adding a layer of security ensures that only verified individuals can access sensitive systems. This includes biometric authentication, smart cards, or physical tokens.

- Account Lockout Mechanisms: Setting lockout thresholds helps prevent brute-force attacks by disabling access after multiple failed login attempts.

Network Security Controls

Proper network security is vital for protecting environments where cardholder data is stored or processed. A few security frameworks mandate the implementation of firewalls, intrusion detection systems (IDS), and other security measures to protect networks:

- Firewalls: These establish a secure boundary between public networks and internal systems holding sensitive information. Firewalls should be configured to allow only necessary traffic and secure protocol.

- Intrusion Detection and Prevention Systems (IDPS): Detects suspicious activities and provides alerts in real-time. Some systems can be configured to automatically block threats, adding a layer of defense.

- Virtual Private Networks (VPNs): VPN is an essential tool for securely transmitting cardholder data over unsecured networks, such as public Wi-Fi or open networks that could be vulnerable to interception. By connecting to the VPN, the user’s data traffic is isolated from other traffic on the public network, reducing the risk of interception.

- Segmentation: Network segmentation isolates the cardholder data environment from other network components, reducing the risk of unauthorized access.

Vulnerability Management and Regular Monitoring

Vulnerability management helps detect and address security weaknesses before they are exploited. Security standards emphasize regular monitoring and assessment practices, such as:

- Patch Management: Regularly updating software and systems is crucial to protect against known vulnerabilities. All operating systems, applications and network devices are required to be patched promptly.

- Periodic Security Testing: Periodically scan for vulnerabilities in systems that store or process cardholder information and conduct penetration tests to simulate attacks and identify security weaknesses to prevent potential exploits

- Continuous Monitoring: Continuous network monitoring helps detect anomalies that could signal unauthorized access or data theft. Security information and event management (SIEM) solutions are commonly used to aggregate and analyze data across the network.

Data Masking and Redaction

Limiting the visibility of cardholder information is essential, especially for those who do not require full access to sensitive details:

- Data Masking: Hides portions of cardholder data (e.g., displaying only the last four digits of a card number) when full information is unnecessary.

- Redaction: Removes sensitive data entirely from documents or records that may be exposed to unauthorized parties.

Secure Payment Systems

Secure payment systems are designed to protect cardholder information throughout the payment process. These systems incorporate various security measures and protocols to ensure data confidentiality, integrity, and compliance with security standards.

- Use of EMV Technology: EMV (Europay, Mastercard, and Visa) cards store cardholder information on a metallic chip instead of in a magnetic stripe. The chips add a layer of security by generating unique transaction codes that cannot be reused.

- Point-to-Point Encryption (P2PE): In environments where transactions take place on physical devices, point-to-point encryption encrypts data at the point of entry (such as a payment terminal) and maintains encryption throughout its transit to the payment processor.

- Contactless Payments: Secure payment systems often support digital wallets, such as Apple Pay or Google Pay, which have built-in security protocols. Digital wallets use device-specific card numbers, biometric authentication, and tokenization, which significantly reduces the risk of card data exposure during transactions.

Implementing Physical Security Measures

Physical access to systems storing cardholder data must be restricted. Security standards recommend physical security measures to control who can access physical locations with sensitive data:

- Access Controls: Implement badge or biometric access for sensitive areas.

- Video Surveillance: CCTV cameras can help monitor access to secure locations.

- Secure Disposal of Media: When media containing sensitive data is no longer needed, it should be securely destroyed to prevent unauthorized recovery.

Employee Training and Awareness

Employee awareness is a critical component of cardholder data security. Staff should be trained on security policies and procedures and trending security incidents:

- Security Training Programs: Educating employees on security best practices helps prevent human errors that could lead to data breaches. Employees and users should be trained on data handling protocols, phishing risks, and incident reporting.

- Clear Security Policies: Ensuring employees understand data handling procedures and the importance of compliance can significantly reduce risks.

Incident Response

Proactive and rapid incident response mitigates the impact of any security incidents, including data breaches, that may expose cardholder data.

- Preparation of an Incident Response Plan (IRP): By responding quickly, organizations can stop a breach before it escalates, reducing the amount of cardholder data that may be exposed. Organizations must establish an incident response plan (IRP) outlining procedures for detecting, responding to, and recovering from security incidents. This plan should include defined roles and responsibilities, communication channels, and ensuring all staff members are trained on their specific tasks.